Financial markets traded with mixed results as major assets reacted to individual catalysts.

How did your favorite assets trade on Tuesday?

Our division:

Titles:

- Flash HCOP France Manufacturing PMI For April: 44.9 vs. 46.2; The Services PMI rose to 50.5 compared to 48.3 previously

- Flash HCOP German Manufacturing PMI For April: 42.2 vs. 51.9 previously; The Services PMI rose to 53.3 from 50.1

- Flash HCOP Eurozone manufacturing PMI For April: 45.6 vs. 46.1; The Services PMI rose to 52.9 compared to 51.5 previously

- Standard & Poor's Global Flash UK Manufacturing PMI For April: 48.7 vs. 50.3; Services PMI at 54.9 versus 53.1

- In a speech he delivered on Tuesday. Bank of England Member Jonathan Haskell He says “The direction we go depends strongly on V/U (the ratio of vacancies to unemployment),“And inflation expectations”It has remained remarkably well established“

- Bank of England Chief Economist Hugh Bell He prefers a cautious approach to lowering interest rates, saying:There are greater risks associated with easing too early if inflation persists than easing too late if inflation declines.“

- Vice President of the European Central Bank, Louis de Guindos He said in a newspaper interview that the June rate cut is a “fait accompli” and that he is “very cautious” about what might happen next

- In a speech he delivered on Tuesday. Member of the Governing Council of the European Central Bank, Joachim Nagel “I shared that”If the positive inflation expectations for March are confirmed in the June forecast and incoming data support these expectations, we could consider cutting interest rates.“

- Standard & Poor's Global Flash US Manufacturing PMI For April: 49.9 vs. 51.9 previously; The flash services index came at 50.9 compared to 51.7

- New home sales in the United States March: 8.8% m/m (2.7% m/m forecast; -5.1% m/m previously); Services index for April: -13 (-5 expected; -7 previous)

- New Zealand Trade It improved from a deficit of NZ$315 million to a surplus of NZ$588 million in March as exports rose 3.8% m/m but imports fell by a whopping 25% m/m.

Broad market price movement:

Dollar Index, Gold, S&P 500, Oil, 10-Year US Yields, Bitcoin Overlay Chart by TradingView

Major financial assets traded mixed, with spot gold extending losses in the Asian session as traders expected easing concerns in the Middle East and increased demand for the US dollar. Bitcoin (BTC/USD) has reversed some of its gains from the previous day, likely due to a bit of profit-taking following the “Bitcoin Halving” event over the weekend.

Price action intensified in the European session thanks to Purchasing Managers' Index (PMI) releases from the Eurozone and the UK which inspired little risk-on. Then, unexpectedly weak US PMI reports during the US session revived calls for a Fed rate cut in June and markets reacted accordingly.

Crude oil recovered its losses during the day, spot gold almost ended the day in the green, and US bond yields fell from 4.65% to the 4.57% area before settling at 4.60%. US stock indices, such as the S&P 500, also rode the “Fed rate cut” train and were boosted by optimism over this week's earnings report releases.

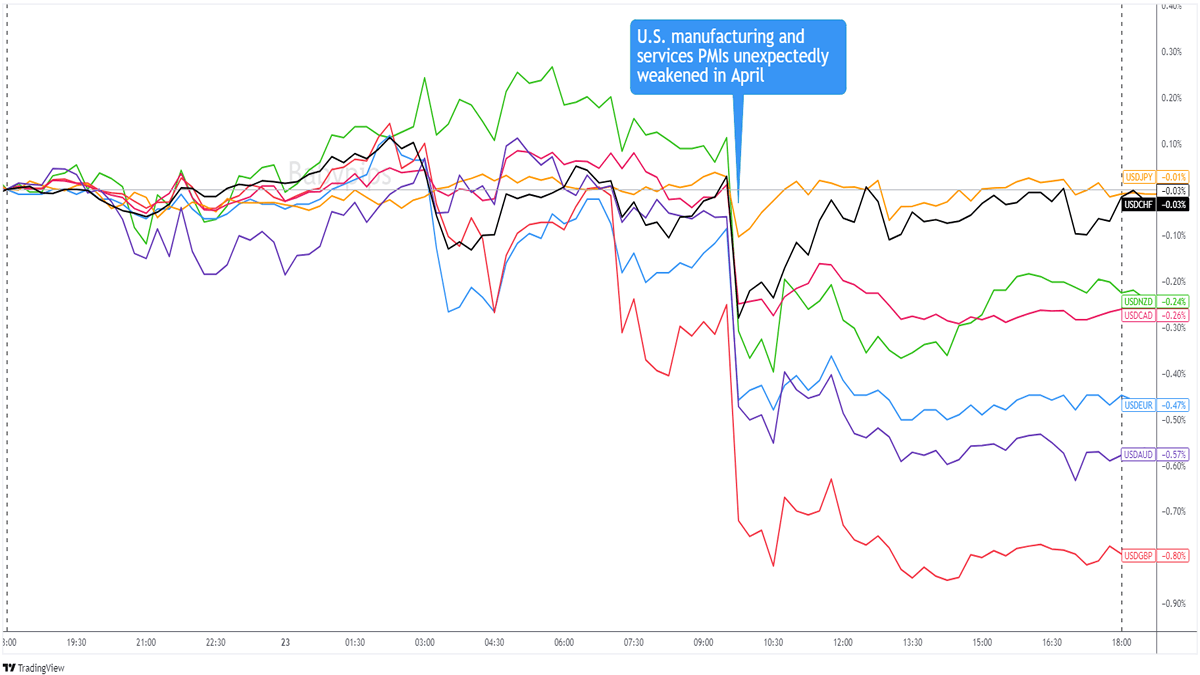

Forex market behavior: US dollar against major currencies

Overlay of the US dollar against major currencies Chart by TradingView

The US dollar traded in tight ranges for most of the day before surprisingly weak manufacturing and services PMI reports during the US session revived Fed rate cut bets.

It did not help the safe haven that PMI reports from Australia and the euro zone surprised to the upside while sterling was supported by Bank of England chief economist Hugh Bell who supports a dovish approach to interest rate cuts.

The dollar ended the day lower across the board, seeing its biggest losses against the British pound, the Australian dollar, and the euro, while losing only marginally against other safe-haven currencies such as the Japanese yen and the Swiss franc.

Potential catalysts coming on the economic calendar:

- Bundesbank President Joachim Nagel will deliver a speech at 7:00 AM GMT

- Credit Suisse economic forecasts at 8:00 AM GMT

- IfO Business Climate in Germany at 8:00 AM GMT

- BoE Industrial Demand Forecast for the UK at 10:00 AM GMT

- Retail sales in Canada at 12:30 PM GMT

- US Core Durable Goods Orders at 12:30 PM GMT

- EIA crude oil inventories at 2:30pm GMT

As more traders look for clues to a possible Fed rate cut, you can bet they will be eyeing the core durable goods reports in the US. EIA crude oil inventory data may also trigger fluctuations in crude oil benchmarks, so make sure you stick to the tube during releases!

Are you looking for your own place to record your market observations and trading statistics? If so, check out TRADEZELLA! It's easy to use

A blogging tool that can lead to valuable insights about performance and strategy! You can easily add your thoughts, plans and track your psychological state with each trade. Click here to see if this is right for you!Disclaimer: Babypips.com earns a commission from any signups through our affiliate link. When you subscribe using our affiliate links, it helps us maintain and improve our content, much of which is free and available to everyone – including Pipsology School! We appreciate your support and hope you find our content and services useful. Thank you!

The post Daily Broad Market Recap – April 23, 2024 first appeared on Investorempires.com.